Towards a Truly Sound Money Supply

In order to achieve its goal of powering a sound money supply for communities around the world, the Intercoin project has had to innovate in many aspects dealing with technology, economics and regulations. We’ve interviewed community currency economists and former regulators, and consulted with some of the teams around the world working on the latest crypto projects. As a result, we were able to draw on some of the best ideas from the last few years.

Intercoin has been designed to be a reliable store of value, enabling it to act as a reserve currency that allows communities to periodically settle their trade imbalances. Thanks to the emergence of smart contracts and decentralized exchanges like UniSwap, we are finally able to design a cryptocurrency that is provably able to hold its value, and in even guarantee that it will never experience severe drops in price!

Intercoin could be the world’s first asset designed to have reliable guarantees about price stability, making it a better store of value than today’s volatile cryptocurrencies.

Speculation and Uncertainty

In 2008, Satoshi designed Bitcoin’s economics in response to the massive bailouts and over-leveraging in the fiat financial system. Back then, much of the financial landscape in 2008 was dominated by individuals and financial institutions engaging in rampant market speculation with derivatives (e.g. in housing and mortgages). And now in 2021, we designed the economics of Intercoin in response to the high volatility of crypto markets. The landscape is similarly full of market speculation by individuals and financial institutions with derivatives – including in cryptocurrencies, the very asset class that were supposed to be an answer to the previous speculative bubbles.

Financial giants like Goldman Sachs, operating on public markets, have been able to manipulate global prices of commodities like aluminum and food. Neither Bitcoin nor Ethereum, let alone currencies with smaller market caps, have been able to avoid large swings upward and downward. If Intercoin is going to become the reserve currency for communities around the world, it has to do better.

Stability and Reliability

In order for community currencies to be accepted by vendors on a daily basis, they have to remain rather stable in value relative to the federal currency (such as USD or EUR). As the reserve currency for communities, Intercoin can be used as collateral backing these “stablecoins”, in a decentralized manner without the need to trust any third parties. Normally, stablecoins backed by crypto assets, would need to be over-collateralized, as the price of those assets can drop due to volatility.

But what if we could design a cryptocurrency whose value would be mathematically guaranteed not to experience significant drops? In that case, we would be able to implement stablecoins and many other applications in ways that are far more efficient and reliable, by taking advantage of properties that only recently became possible to guarantee:

https://community.intercoin.org/t/intercoin-application-stablecoins

How to Design a Reliable Store of Value

What if we could design an asset that would only go up in price, but never down? If people paused buying the asset, the price would pause going up. If people sold it, however, the price would not drop. This would seem to be the “holy grail” for those looking to park their money in a reliable store of value. And knowing the asset would never again be cheaper than it was today would create perpetual fear of missing out for many people. Such an asset would “out-bitcoin Bitcoin”.

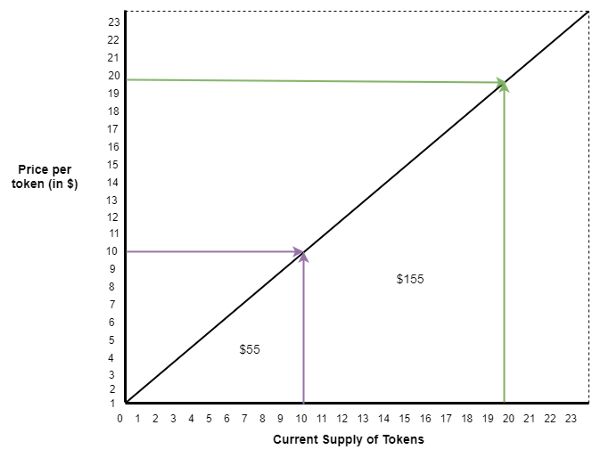

Well, it’s possible to create such an asset – let’s call it AlwaysGoesUp (AGU) – using today’s DeFi technology. The easiest way to describe that is to start with a bonding curve that will increase the price linearly as people buy the token:

The AGU smart contract would accept ETH from any address, and send it back AGU according to the linearly increasing price formula above. The proceeds from each sale would be automatically distributed as follows:

- 10% to the ETH-AGU liquidity pool on UniSwap

- 10% to the team and initial investors (whoever is holding the investor tokens)

- 80% to the buyback fund that will be used to support the price after sales.

Thus, any address holding AGU tokens could send some back to the issuing smart contract and receive ETH in return. How much ETH they receive would be calculated as follows:

- Recall that the price should never decrease after a sell, only increase after a buy.

- So, if absolutely everyone sold their AGU at the same price, this would be represented by the rectangles in the diagram above, that are enclosing the triangles.

- But, the amount collected in the buyback fund is equal to 80% of the area of the triangle underneath the line in the diagram above, i.e. 40% of the rectangle.

- Therefore, on average, everyone would have to receive 40 cents on the dollar, i.e. pay a 60% haircut / tax

- The very first AGU to sell could pay a 30% tax, and then it would increase linearly to 90% tax for the very last person to sell, assuming absolutely everyone sold in a “run on the bank”.

Notice that the smart contract is able to pay everyone out, even in the case that every last person and their dog goes to dump the token. Most good crypto projects would never even come close to this “worst-case scenario”, for example 60% of Bitcoin is held by entities who have never sold more than 25% of their holdings. In such circumstances, the linearly increasing tax would not reach more than 35%, so the losses for anyone who has ever bought AGU tokens would be capped at 35%.

This is quite a guarantee, compared to the volatility of nearly all other crypto tokens out there – including Bitcoin! Usually, people who bought in “somewhere near the top”, which is the majority – are left holding the bag when the price drops. They may get tired of waiting for new buyers to come in after them, and “panic-sell” at a loss. With AGU, their losses would be capped. In fact, even in the absolute worst case if absolutely everyone sold out – without anyone buying in the meantime – the very last people to get out would still get 10% of their money back – unlike in most market crashes where they’d get 0.0001%.

DeFi and smart contracts enable orderly markets with deterministic prices. While demand to buy or sell AGU tokens may vary, the linear increases in prices and cash-out taxes bring a measure of predictability for everyone involved. We could even cause decentralized exchanges like UniSwap to implement these tokenomics.

Secondary Markets

The AGU smart contract essentially makes a market in AGU tokens, with a spread of at least 30% at any given time. This gives an opportunity for exchanges (both centralized and decentralized) to list AGU tokens, with market makers (including automated market makers), creating a much tighter spread. People would trade the AGU token there, with the price varying between the spread. Technically speaking, the “AGU” price could drop temporarily on these secondary exchanges, but only within a certain range. Still, the bid and ask prices on the exchange would be more attractive than on the smart contract: no rational trader would buy for more, or sell for less, than they could if they interacted with the actual AGU contract.

When the price on the secondary markets begins to exceed the current price offered by the AGU contract, rational buyers would just buy the tokens from the contract directly. The price curve is linear, which grows slower than the price curve on UniSwap, so the cost to obtain AGU would be strictly smaller.

The Intercoin Smart Contract

The above proof of concept shows that it’s possible to create a token whose price is guaranteed to never go down against ETH, USDC or whatever asset it’s being sold for (unless something goes wrong with USDC, or the Ethereum blockchain). That’s quite an attractive guarantee, but who would buy this token, knowing that they’d lose 30% whenever they’d try to cash it out? Only those who believe the token will go up by at least 30% in value after they bought it.

The token’s primary sale attracts long-term investors, while keeping out day traders and speculators, who would normally dump the token as soon as they felt like it. Venture Capitalists are used to waiting 7-8 years for an exit, so what’s another 90 days? Retail investors may find it similar to CD accounts at banks which have a penalty for withdrawing early.

Day traders and speculators may still choose to trade within the 30%+ spread between the buy and sell prices of the issuing smart contract. However, this would result in price volatility on those secondary exchanges, but would help those who want to “cash out immediately”. There is a trade-off: allowing totally free trade leads to price volatility that imposes a cost on regular commerce, e.g. the need to over-collateralize the community currencies to ensure price stability.

To implement additional stability, Intercoin could go further than AGU, and implement a progressive tax on transfers between any on-chain addresses. For example, transferring only 5% of the balance per day could be done tax-free. This would require 90 days to liquidate 99% of one’s balance tax-free, and then take a small hit for the remaining 1%. Any account transferring amounts greater than 5% per day, however, would incur linearly increasing taxes, possibly reaching 60% if they transferred their entire INTER balance in 1 day.

Actual Communities

Recall that Intercoin’s purpose is to act as a bridge currency for communities to hold on reserve, and periodically settle their trade balances with one another. These communities are the intended users of the Intercoins, and they buy Intercoins for the long-term (as opposed to day traders and speculators).

Under normal everyday trade between one another, communities would not incur trade daily deficits of more than 5% of their entire economy. A community that transfers 100% or even 50% of their Intercoin to another community per day is experiencing serious capital outflows that are threatening to liquidate their entire Intercoin-backed economy in a couple days, creating serious shocks for their members. Thus, the taxes on transfers also serve to incentivize communities to establish sustainable and manageable trade with others, encouraging them to balance outflows in one type of goods with inflows in another. And, if communities find people are cashing out too much, they can always vote to mitigate this by imposing an internal “exit tax” on future investments in the community currency.

Summary

Intercoin could be the world’s first asset designed to have reliable guarantees about price stability, making it a better store of value than today’s volatile cryptocurrencies. The recent innovations in DeFi technology allow Intercoin to accomplish this in a decentralized way that doesn’t require trusting any third party.

The fees on transfer can help keep the day traders and derivative traders out, and at the same time subsidize the ability to provide robust guarantees about price stability. They also encourage communities to establish long-term relationships with one another, and be responsible about their trade balances.

While all this applies to the backbone of the system (reserves, transfers), regular users can go about their day using community currencies, that can remain stable against their federal currency like USD and EUR, without their communities needing to over-collateralize their reserves.